The Science Behind Investment Choices

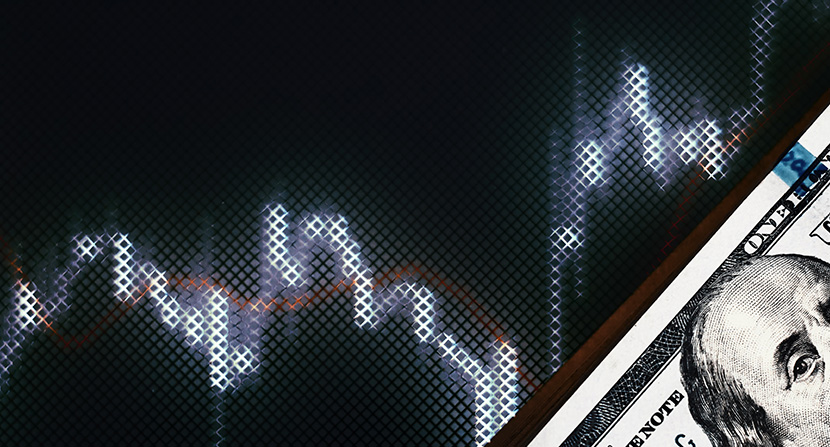

Investment is a huge world, and it shouldn’t come as a surprise to learn that a lot of science and math goes on behind the scenes. In this article, we’ll explore the science behind investing, breaking down the big problems that need to be overcome and how you can ensure you get it right.

Whether you trade crypto and stocks, or just want some trading forex UK advice, this article should tell you a lot about the science behind trading and all the key facts you need to be aware of before diving into trading.

How To Invest Methodically

The science behind each type of investment is different. The first thing to understand is that there are two types of investment:

- buying assets such as stocks, bonds, and currencies

- investing in a company by providing it with capital in return for equity (a share in the business)

Buying Assets

https://pixabay.com/photos/newspaper-stocks-stock-price-pen-1081412/

Buying an asset is preferred by many because it is something tangible that you can track the price of easily; you’re essentially betting on the price of that asset going up in the future so that you can sell it for a tidy profit. This is purely speculative, but by doing the necessary research at the start of the investment process, you can make sure that you have the best chance of success.

This is seen as speculative because you can’t say for sure whether the price will go up, no matter how accurate your forecasting model is. In recent years, cryptocurrencies have been very popular to trade as the market volatility has meant that prices can rise (and fall) very quickly. Getting this forecasting right is difficult, but if done correctly, you can get outstanding returns.

Investing Capital

On the flip side, you can also invest by acquiring equity in a company in exchange for capital, buying shares in the hope that, in the future, the company will be worth a lot more than when you bought into it. This method is generally simply referred to as “investing,” as, for many years, this was one of the most common ways for people to invest their money, way before cryptocurrency was big.

Choosing which companies to invest your capital into is a very scientific and mathematical process. When this is done, a smart investor will look at how the market is expected to behave and how this will impact specific industries and the businesses that operate there, as well as the underlying financial figures for that company. There are many, many things at play here.

The Different Types Of Investing Strategy

https://pixabay.com/photos/stock-iphone-business-mobile-phone-624712/

There are a number of factors that you need to take into account when making investment decisions, and these can be broken down into three main categories. This isn’t an exhaustive list of all the forms of analysis and strategy that you can choose from, but they do make up the foundation of smart and well-planned investing.

Fundamental analysis

Fundamental analysis is one of the most common ways for investors and traders to assess the potential of a deal, looking at financial figures to make a snap assessment of how any potential deal could go. This process will involve looking at the company’s financial data and performance in order to clearly forecast future revenues and profits and assess the deal’s profitability.

Technical analysis

Technical analysis is, as it might sound, a lot more technical than fundamental analysis and will involve looking at more external data and charts in order to get a better idea of how the market will behave in the future. This will help the trader look at how the price of the investment will change moving forward, making it easier for them to know when to buy or sell their stake.

Risk management

This is the process of minimizing your exposure to risk by diversifying your portfolio and making sure that you are never too reliant on any one industry or asset type. Because the markets can be very volatile and can act without much warning, you should always make sure that you never over-leverage yourself or become too tied to any one asset, market, or industry.

So what do you think? Investing is a highly scientific way to make your money work harder for you and involves a lot of work behind the scenes, especially when it comes to doing your due diligence before actioning a trade. If you want to get the very best possible outcome, you should always do your homework and be familiar with many forecasting and analysis models.